If you have a teen motorist at house, it is much better to have great personal responsibility coverage with a reduced insurance deductible because brand-new vehicle drivers are prone to making errors. Prices to cover teen vehicle drivers will automatically be higher due to the fact that of their lack of driving experience.

Even seasoned vehicle drivers with past blunders, such as relocating infractions or crashes, might additionally need to pay greater costs. Defensive driving courses help to counter a few of the price (but Helpful site not all of it) so drive carefully and purposely to stay clear of paying higher premiums. Driving Records and also Insurance coverage Fees The insurance deductible is vice versa symmetrical to the costs quantity.

This partnership mirrors whether you prefer to pay basically from your own pocket before extending your hand to the insurance company. Whichever option you choose, make sure you can manage it. Some individuals are better off paying a higher regular monthly costs for a lower deductible to stay clear of any big repayments after an accident (credit).

Exactly How to Purchase Car Insurance Picking the right coverage is the very first step to acquiring automobile insurance. The following is choosing a good insurance policy firm. This can make certain that you're able to obtain the coverage you need at the prices you want while optimizing the chances that your insurance claims will certainly be paid.

There isn't much difference in rate among insurance coverage business since of mandates in some states. Firms will certainly estimate different costs for similar coverage in other states.

The smart Trick of How To Have Your Auto Insurance Deductible Waived That Nobody is Discussing

vehicle insurance cheaper car insurance auto insurance insurance affordable

vehicle insurance cheaper car insurance auto insurance insurance affordable

Nevertheless, you can help confirm to your automobile insurance company that you're not responsible by taking pictures with your cellular phone, exchanging contact info with the various other driver, calling the authorities, making an authorities record, speaking to witnesses, as well as retaining a lawyer - low cost. This procedure coincides for all insurance coverage companies.

There are many different factors why an auto accident can happen, but there is normally some kind of neglect entailed (insurance company). Typical sorts of negligent driving situations consist of: Speeding up and striking another automobile, Sidetracked driving (texting, talking on the phone, altering the radio, and so on) at the time of the accident, Driving intoxicated (intoxicated, on medications, etc)Making an inappropriate turn or lane modification as well as triggering a crash, Running a traffic signal or otherwise quiting at a stop indication as well as striking an additional automobile I Paid My Deductible However the Accident Wasn't My Fault, What Should I Do? One method or another, someone will have to spend for your insurance deductible from a crash.

If the various other driver is at-fault for the auto crash and you have actually collected accurate evidence from the scene of the accident, filed an authorities report, and got a duplicate of your medical record, you can show they are at-fault and also recover problems from them with an automobile mishap case negotiation.

If the various other chauffeur or their insurance provider still will not budge, you can take them to test with the aid of your car mishap legal representative to recoup damages - auto. How Much Time Does Deductible Recuperation Take? It is simple to recuperate your deductible after your automobile was struck by another vehicle if you deal with it the proper way.

This will verify all the necessary details as well as permit the insurance provider to coordinate the details of your deductible. Do I Pay an Insurance Deductible if I Strike a Vehicle? You do not pay a deductible if you are at fault relative to fixing the other broken vehicle. To state one more means, you will not pay an insurance deductible if the owner of the other automobile makes an insurance claim against you.

Rumored Buzz on What Happens If You Can't Afford To Pay Your Insurance ...

Various Sorts Of Insurance Claims After a Vehicle Crash If you are in a car accident that happens in St. Louis, and one more vehicle driver was at mistake for the accident, you may sue against the at-fault vehicle driver's insurance provider. You can do so because the state of Missouri is a fault-based state when it concerns automobile accidents (low-cost auto insurance).

cars cheapest car insurance affordable cheap auto insurance

cars cheapest car insurance affordable cheap auto insurance

At various other times, the at-fault motorist might have insurance policy, but it might not suffice to cover the expenses of your clinical expenditures and also various other problems. In either of these instances, you may need to rely on your very own car insurance coverage company if your limits of protection go beyond those of the at-fault chauffeur. insurance company.

All of this clinical treatment can be expensive, as well as in some instances, the at-fault vehicle driver is entirely without insurance or does not have ample insurance policy protection to compensate you for your injuries. Along with compensation for injuries, you might have experienced psychological distress, pain and also suffering, and also other compensable damages as an outcome of your injuries in the mishap.

Vehicle drivers can likewise trigger accidents when they are sidetracked or transform their attention away from the roadway, also momentarily. Motor vehicle chauffeurs can trigger significant crashes when they are under the impact of alcohol or drugs while they are behind the wheel of a cars and truck. The state of Missouri requires motor automobile drivers to bring minimal insurance coverage, some vehicle drivers do not prioritize doing so.

When that happens, the crash victim can rely on their very own insurance policy business and also file an insurance claim for uninsured driver advantages. The crash target's insurer can after that tip right into the shoes of the at-fault motorist and also provide the required insurance protection. A crash target may likewise file a without insurance driver case in a phantom lorry mishap instance.

The Ultimate Guide To Auto Insurance Deductibles Simplified - Coverage.com

Simply put, they are not lugging insurance protection that suffices to compensate the accident victim for their injuries and various other problems. The accident target may have endured an irreversible injury that will affect them for the rest of their life, and the at-fault driver could just be carrying marginal insurance protection.

When you resort to filing a without insurance or underinsured driver insurance claim with your own insurance company, the insurance policy business will likely treat you as its worst adversary. Although insurance policy firms are not expected to retaliate by elevating your prices or costs, they can still be challenging to work with when it pertains to working out or prosecuting an uninsured/underinsured driver claim.

Rather, it makes money by gathering costs from insureds as well as keeping that cash in-house - credit. As a result, your insurance policy firm may attempt to pay you as little compensation as possible to solve your without insurance or underinsured driver case. That is where a well-informed as well as seasoned St. Louis cars and truck mishap attorney at Dixon Injury Company can action in and also assistance.

We can aid you with bargaining a favorable negotiation in your uninsured or underinsured driver case as well as will certainly work to get you the claim's full worth. If the insurance provider does not move on its deal, we can prosecute the instance in the court system, and if needed, take it to a jury trial.

The instance will certainly after that experience the discovery process, much like with any type of various other individual injury situation, as well as the matter can resolve at any point along the means (low cost auto). If the instance does not fix via the settlement procedure, the celebrations may choose to take the instance to trial and let the jury make a decision every one of the disputed problems.

How Do I Set My Comprehensive Insurance Deductible? - Usaa Fundamentals Explained

The experienced St. Louis vehicle mishap lawyers at Dixon Injury Firm are equally as experienced at the settlement negotiation table as they are in the court. Our lawful group will look at the very best alternatives for your instance and aid you pick the one that ideal fits your demands - car insurance.

You may be stuck to clinical costs and also the price of repair services for a collision that you did not cause. cheapest car insurance. Having a car mishap attorney on your side can avoid you from having to think this obligation. They can likewise guarantee you take every necessary step to hold the at-fault motorist in charge of paying your insurance coverage deductible.

See what you could conserve on automobile insurance policy, Quickly contrast customized prices to see just how much switching automobile insurance coverage might conserve you. Shop about, Although vehicle insurers use comparable elements like age, driving history and location to calculate your vehicle insurance costs, they evaluate these elements in a different way.

We found that prices vary by hundreds of dollars a year. Great chauffeurs with great credit rating can save more than $150 a month, on standard, by switching from the most to the least expensive insurance provider in their state. And savings can be even bigger for vehicle drivers with a current at-fault crash or inadequate credit score almost $250 as well as $400 a month typically, specifically.

And the most affordable company for an excellent vehicle driver with excellent credit may not be least expensive for a person with, state, a drunk driving or a recent mishap. To decrease your auto insurance prices, obtain quotes from several business annually - vehicle. Nerd, Pocketbook's car insurance coverage comparison tool can also help you find the most effective bargain.

Things about Guide To Car Insurance - Investopedia

Make use of car insurance policy discount rates, Every insurance provider offers unique means to save money on your vehicle insurance coverage premium. To make sure you're getting all the discounts you're qualified to, take a look at your insurance company's discount rates page as well as ask your agent to evaluate your possible savings. Our auto insurance policy discount rates page gives more details on what insurers provide various price cuts.

If your car deserves much less than your insurance deductible plus the amount you spend for yearly protection, after that it's time to drop them. Accident and detailed never pay out greater than the vehicle deserves. Assess whether it's worth paying for coverage that may reimburse you only a tiny amount (vehicle insurance).

Put it in a fund for vehicle repair services or a down settlement on a newer car as soon as your clunker conks out. See what you could conserve on car insurance policy, Quickly contrast tailored prices to see how much switching automobile insurance might save you. 5. Drive a vehicle that's low-cost to guarantee, Prior to you purchase your next automobile, compare car insurance rates for the models you're considering.

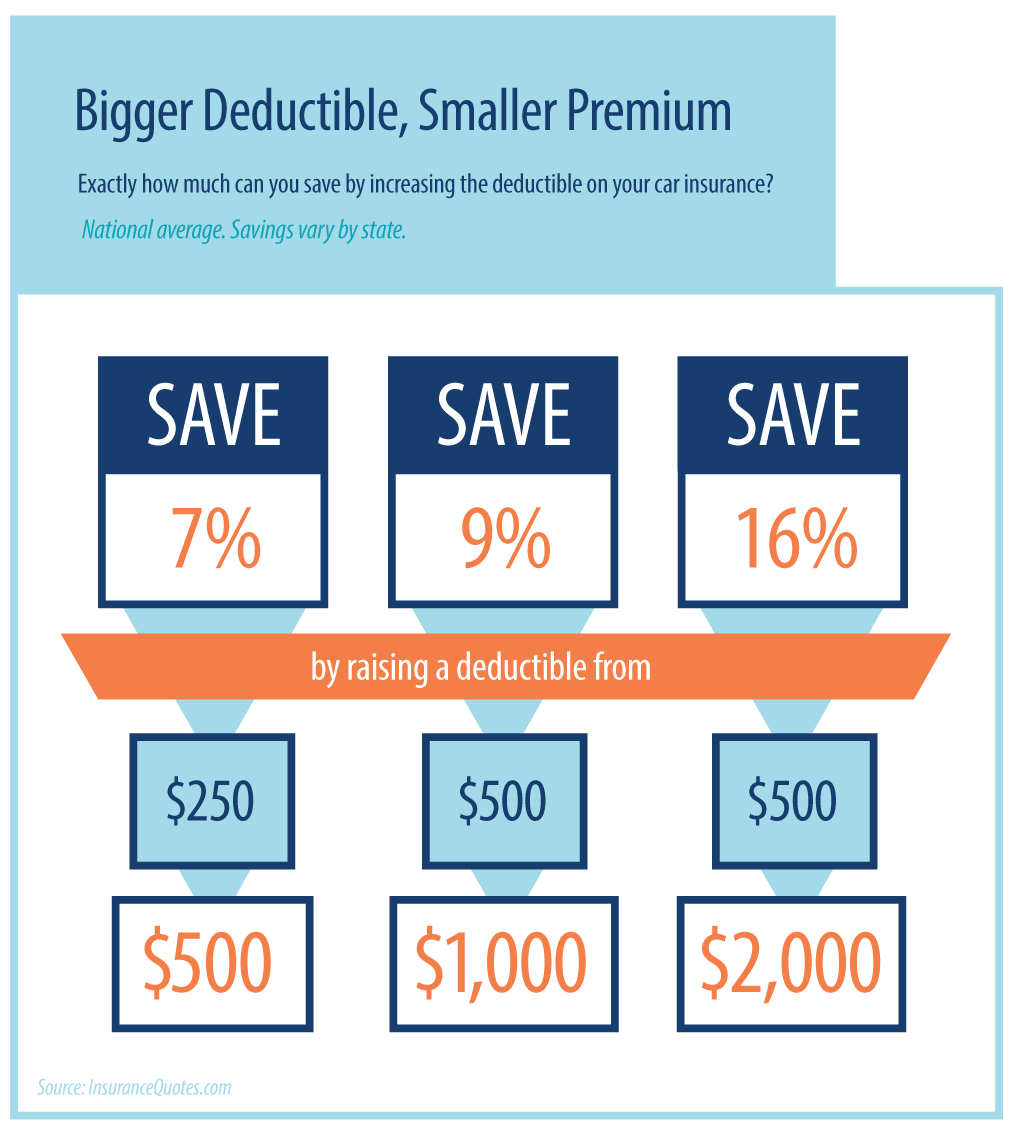

Safe and also moderately valued vehicles such as little SUVs often tend to be less costly to guarantee than showy as well as pricey cars. 6. Enhance the insurance deductible, You can conserve money on collision and also detailed insurance policy by raising the deductible, the amount the insurer doesn't cover when spending for fixings. If you have a $500 deductible as well as your repair work expense is $2,000, the insurance firm will certainly pay out $1,500 once you have actually paid the $500.

trucks cheap car insurance company cheapest car insurance

trucks cheap car insurance company cheapest car insurance

Boost your credit, Your credit can be a huge factor when vehicle insurance companies determine just how much to bill. It can count also more than your driving record in some cases.

Little Known Facts About What Is A Car Insurance Deductible? - Kelley Blue Book.

It's feasible to get a price cut simply for authorizing up for several of these programs, so they could seem like a piece of cake (cheapest car). Some insurance companies might increase your prices if you're deemed a harmful driver. Make certain to examine what behaviors are tracked and just how your price is influenced before enrolling.

Understanding the distinctions in between the kinds of protections that are available can assist you select a plan that is best for you. The sort of insurance coverage you require relies on a variety of variables, consisting of the state you stay in, whether you own or lease the cars and truck, and also the age of the vehicle you drive.

This protection offers compensation for injuries to others, and for the damages your lorry does to an additional individual's home if you trigger a crash. car insured. If you are located in charge of causing problems as an outcome of an accident, this coverage might compensate to the restriction you pick, and also it can offer a lawful protection if you're filed a claim against.